COVID-19 Resource Page

Protecting members and employees in response to the health threat posed by the virus.

Dear Peninsula Credit Union Member,

Our website is a great place to find current information related to Peninsula Credit Union and COVID, including any changes or service interruptions that affect members. Our Facebook page will also provide timely and ongoing updates. Please know that the health and safety of our members and employees is of utmost important to us.

For more information and the full list of recommendations from the CDC, please see the Centers for Disease Control (CDC) guidelines.

If you have any questions specifically about your accounts, you can send us a secure message using online or mobile banking, or give us a call at 800.426.1601

Thank you for being our member,

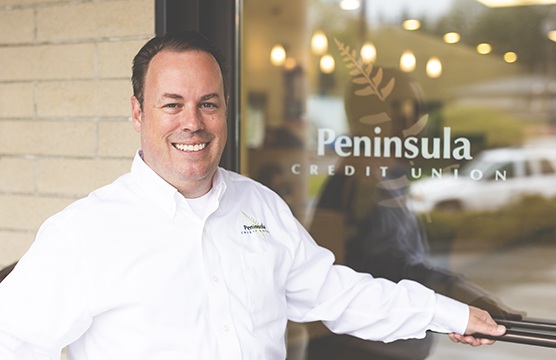

Jim Morrell

President/CEO

Peninsula Credit Union

Recent updates:

August 16, 2021 Email to Members – Updates to masking policies

July 06, 2020 Letter to Members – State Face Mask Mandate

May 27, 2020 Letter to Members – Re-Entry Plans

April 10, 2020 Letter to Members – Stimulus Payments

March 23, 2020 Letter to Members – Member Assistance

March 17, 2020 Letter to Members – Lobby Closures

March 9, 2020 Letter to Members – Acknowledgement of COVID-19

Federally insured credit unions like Peninsula Credit Union offer a safe place for credit union members to save money. All deposits at federally insured credit unions are protected by the National Credit Union Share Insurance Fund, with deposits insured up to at least $250,000 per individual depositor. Credit union members have never lost a penny of insured savings at a federally insured credit union. Additional information on NCUA share insurance coverage for consumers is available at MyCreditUnion.gov.

PCU in the News

PCU Videos

Masking Policy Updates August 16, 2021

In this episode, Jim Morrell discusses the state mandated mask requirement, as well as alternative methods to do your personal banking.

State Face Mask Mandate

In this episode, Jim Morrell discusses the state mandated mask requirement, as well as alternative methods to do your personal banking.

A Message From the CEO

This update from Jim Morrell our CEO about plans moving forward and when we will begin re-entry during the four phased approach from Governor Inslee.

Navigating Unemployment Video

If you lost your job or saw your hours cut because of COVID-19 it can be difficult to know how to start the Unemployment process. We have researched some tips to help you during this process.

What Should you do With Your Stimulus Payment

In this video we discuss different ways you can use your stimulus payment while being financially responsible. While they may not be glamorous these little actions can make a big impact on your finances.

Fraud Tips from Jim Morrell

During this time of crisis scammers are still out trying to take advantage of all of us. In this video Jim shares some tips to keep yourself safe during these trying times.

Peninsula Credit Union Employees 3D Print Personal Protective Equipment for Hospital Workers

Two employees have made over 100 face shields and other equipment for healthcare workers.

Click here to read the article.

The Remarkable Credit Union Podcast

Our President and CEO Jim Morrell was on the Remarkable Credit Union podcast. He has a great dialog with host Cameron Madill about this COVID-19 crisis and how credit unions can help their members find financial peace during these turbulent times.

Radio Interview

Jim Morrell, CEO and Kirk Smith were interviewed by Jeff Slakey IFIBERONE News Radio – KMAS about what consumers should do during this crisis and specifically what Peninsula was doing to help its members. Listen to it here.

Shelton Mason County Journal

Peninsula was featured in a recent article in the Shelton Mason Journal about service levels in Mason County. To read the article

Here are some methods of banking you can use to manage your finances while practicing social distancing.

- Online banking

- Mobile banking Download the app for Apple or Android devices.

- Secure Messaging (after logging into online banking)

- Peninsula and Shared Branch ATMs

- Mobile Deposit

- Telephone Banking: 800.426.1601

- Mail: Peninsula Credit Union, PO Box 2150, Shelton, WA 98584

- Day/Night Drop Deposits: All branch locations (Will be checked throughout the day)

- Online Notary Service: Notarize Any Document in 5 Minutes or Less

1. Calculate your financial runway. How much money do you have? How long will that last? How much work (unpaid) will you be missing? What bills are coming up? What is the financial gap?

2. Prioritize your payments. Housing should be first. Perhaps student loans can be deferred for 6 months?

3. Look into solutions that will help you with temporary relief and an increase of cash flow during this temporary setback, (loan extensions, loan modifications, low interest loans for disaster recovery, waived fees, etc…) Reach-out to creditors/lenders to seek temporary relief too.

4. Here is a great BALANCE tool-kit called, Surviving a Financial Crisis.

5. Here are a couple of articles that may be helpful too:

What to do if your income is reduced?

Cut these costs immediately if you are facing a financial hardship.

Unemployment Fraud 1099-G Tax Forms

If you receive an incorrect Form 1099-G for unemployment benefits you did not receive you should contact the issuing state agency. With unemployment fraud that happened in 2020, be on the lookout. To learn more, check out this IRS news release.

Urgent News: (5/15/2020)

The State of Washington is suspending unemployment payments for the next several days as they investigate this issue. If any individual believes they have been a victim of imposter fraud, They are advised to go to esd.wa.gov/fraud and report it immediately using the instructions on that page.

It’s no secret that fear causes people to make rash decisions. That’s why people buy out all the toilet paper on the shelves when a pandemic is announced. Scam artists know this and use times of fear to manipulate others into giving them money or personal information, in fact, scamming is so prevalent during these times that the Federal Trade Commission created a Scam Bingo Sheet with some of the most common scams. It’s times like these that you need to be extra vigilant about who you’re giving information to and where your hard-earned money is going. Note that seniors are particularly vulnerable, please talk to your elderly family members about these scams and how to avoid them.

Fake Emails, Texts, and Phishing Scams

Phishing is a huge problem and is a favored method by many scammers. According to Dictionary.com Phishing is defined as “trying to obtain financial or other confidential information from Internet users, typically by sending an email that looks as if it is from a legitimate organization, usually a financial institution, but contains a link to a fake website that replicates the real one”. This can happen with any and all financial institutions, for example, you may get an email from someone claiming to be Peninsula Credit Union that requests for you to click a link or call a number and reveal personal information. In some cases, clicking the link alone is enough for the hacker to infiltrate your computer and find your personal information.

So, how do you avoid phishing scams?

-

Know what information you need to guard. Scammers are looking for things like account numbers, social security numbers, login IDs, and passwords. If someone asks you for any of this information, be certain that they are a trusted source.

-

Do not provide personal information to unknown sources. If you cannot verify the identity of who is calling you, texting you, or the source of the email, do not provide information.

PCU Tip: To verify that it is Peninsula Credit Union calling you about your account, you can always ask for the name of the person you are speaking to, hang up, call our contact center (1.800.426.1601) and asked to be routed back to that employee.

Robocalls

In much the same way as phishing, scammers use robocalls to target individuals for private information. These calls could be set up to come from many sources that seem reputable on the surface, places like the Social Security Administration, Medicare, or even your financial institution. Robocalls may be trying to steal PIN numbers, account information, or trick you into buying gift cards.

So, how do you avoid Robocall scams?

-

Hang up immediately, do not push any buttons or speak. As a rule of thumb, if someone needs to gather personal information, they will not use a robot to do it.

PCU Tip: We’ll never ask for your personal information with a robocall. When in doubt, call our contact center (1.800.426.1601) to see if need anything from you.

Fake Cures & Testing Kits

Scammers and businesses prey on people’s fear by trying to sell products or services that claim to prevent or treat the coronavirus. These can be anything from oils and teas to therapeutic sessions. While government agencies are trying to crack down on these scams, some do manage to slip through the cracks.

So, how do you avoid fake cures and testing scams?

-

Don’t purchase anything that claims to treat or prevent coronavirus. Currently, the Federal Drug Administration says there are no approved cures or at-home testing kits.

Charities

The times are uncertain and many people are more than willing to lend a helping hand. Be careful when being solicited for donations to charities that claim to help those affected by the virus or doing research. There are reputable organizations that do need your help and contributions, but there are also scammers who are trying to pull on your heartstrings and steal your money.

So, how do you avoid charity scams?

-

Do your research. If the charity that is contacting you is one you’ve never heard of before, tell them that you’d like to look into them a little more before making a financial contribution. If someone is claiming to be a well-known charity, consider making the donation directly through their website rather than over the phone, this way you can be sure your contribution is going directly to them and not a scammer.

We understand that many people in our community will be impacted by the COVID-19 pandemic, and many organizations that provide assistance to those in need will need more support than ever before. Here are a few organizations you can support with donations or volunteer your time:

Mason County

- Crossroads Housing

- Saint’s Pantry

- North Mason Food Bank

- North Mason Resources

-

Mason County COVID-19 Response Fund – Donate today to support nonprofit organizations that serve Mason County residents

Kitsap County

Jefferson County

- Port Townsend Food Bank

- Tri-Area Food Bank

- Quilcene Food Bank

- Local Investing Opportunities Network (LION)– LION creates opportunities for local businesses, nonprofits, and citizens to network.

General Resources

- 2-1-1 is the easy to remember number for health and human services in your county for over 20 years.

- Washington State Coronavirus Response

- Financial Resources for Washington Residents Impacted by COVID-19 from the Washington State Department of Financial Institutions (DFI)

- COVID-19 Resources for Washington Small Businesses from DFI

- Coronavirus (COVID-19): Small Business Guidance & Loan Resources from the U.S. Small Business Association (SBA)

- Disaster assistance information for businesses and homeowners from the SBA

- For workers and businesses affected by COVID-19 (coronavirus) from the Washington State Employment Security Department

- COVID-19 resource list for impacted Washington businesses and workers from the Washington State Governor’s office

- Working Washington Small Business Emergency Grants Apply for up to $10,000 in emergency funding

Education Resources

Lending Options to Help You Now

Loan Modifications

We can offer interest only and payment deferral options. Call today to discuss which may be best for you.

Release of Held Funds on a Secured Loan

Members can request a release of the held savings for an active borrow and save loan, share secured, and VISA secured for up to $1,000 or 25% of the held amount whichever is higher.

Fee Free Refinances of PCU Loans

We have waived the $100 fee to refinance your PCU loan**. This may help you lower your monthly payments as we have low interest rates.

Products and Services to Help You Now

Penalty Free Certificate Withdraw

If you have a certificate with us, and are experiencing a financial hardship due to COVID-19, we will waive the penalty fee if you wish to withdraw funds from the certificate early

No Fee Cash Advance

With an appointment you can come into the branch and do a VISA cash advance for no charge

Featured resources for our members

COVID Family Financial Survival Guide

Peninsula Credit Union has been certified since 2014 as a Community Development Institution (CDFI) identified by the U.S. Treasury to have a focus on financial challenged households in our community. CU Strategic Planning is our partner helping to design products for credit unions to help build financial stability.

In this guide topics covered will include

- Difficulty Paying Rent

- Getting & Saving Your Cash

- Protect Your Credit

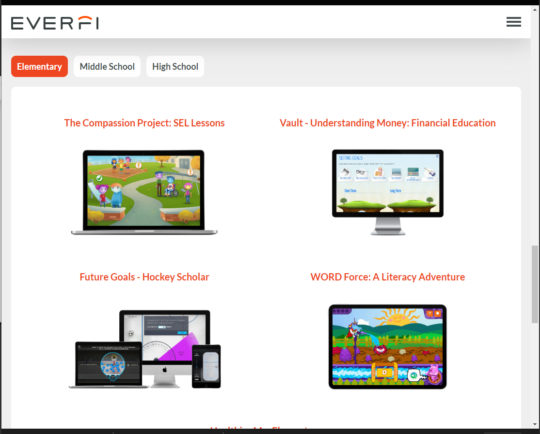

Digital Lessons for Remote Learning

EVERFI is here to help families bring learning to life at home. EVERFI’s digital lessons are used by more than two million K-12 students, and thanks to our sponsors, are always available to school districts and educators at no-cost.

In this period of increased remote learning, we’re also providing students direct-access. We invite you to visit EverFi and access this comprehensive information.

- Elementary School

- Middle School

- High School

Every time we see a crisis like government shut-downs, hurricanes, tornadoes, fires, or in this case, a virus outbreak, the financial fragility of American’s is brought “out of the closet” and into discussion. Helping those we serve get from barely surviving to financially thriving is our collective goal! If you are not prepared for this sort of financial setback, we hope this information can assist you in moving forward. As you recover, don’t forget to plan ahead for the future. Our hope is that we can keep the “Financial Health” conversation alive every day, not only in times of emergency.

Financial Education

Free Access to Financial Education and Resources

At Peninsula Credit Union, we care about your financial wellness. That’s why we’ve partnered with industry-leading BALANCE to provide you with free access to expertly-crafted financial education and resources to help with your fiscal matters. And should you need, BALANCE can assist with confidential, no-cost financial counseling services to help you develop a sensible budget managing spending and debt. For all your financial life stage changes and more, we—in partnership with BALANCE—are here to help.

Register for BALANCE Today

Have questions about out what you can do at this time?

Disclosures

*APR=Annual Percentage Rate. Loan approval is subject to Peninsula Credit Union underwriting guidelines. Payment example: $555.56 a month based on 18 months, $10,000 loan amount at 0.00% APR or $559.98 a month based on 18 months, $10,000 loan amount at 1.00% APR.

**Some Exclusions Apply

COVID-19 is a highly contagious disease that can kill you. Protective measures that we take and you take cannot eliminate the risk of exposure when you visit a public place such as a Peninsula Credit Union office. Please use our online, mobile, telephone, or drive-through services rather than visiting a Peninsula Credit Union office whenever possible. If you visit any Peninsula Credit Union office, you are responsible for all risk of COVID-19 exposure.