Banking Services

Helpful features to help you move, give and receive money, quickly and seamlessly.

LOGIN TO ONLINE BANKING

Peninsula offers the following banking services:

Direct Deposit

Get your paychecks, or other recurring payments deposited directly into your account. It’s free, safe, easy and green.

Pay Loans Now

Pay your Peninsula loan payments online with your debit card or checking account from any financial institution.

Wire Transfers

A secure way to move funds quickly between people and businesses, in the U.S. and internationally.

Helpful Details

Make deposits simpler with Direct Deposit.

Direct Deposit makes it easy to receive your paychecks directly into your Peninsula checking account. Income from your employer, Social Security, pension and retirement plans, the military, VA benefits, and dividend or annuity payments may be electronically deposited into your account using Direct Deposit.

Setting up direct deposit with your employer or whoever you’re receiving checks from is quite easy—you simply need to provide them with a few pieces of key information:

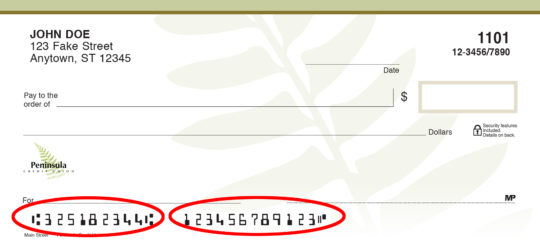

- Peninsula Credit Union Routing number: 325182344

- Your 12 digit checking account number that starts with 7890.

If you have a paper check handy, you can easily find the routing number and checking account number in the lower left hand corner. Please use all 12 digits of your account number when setting up the transaction. Note that your member number is not the same as your checking account number, and isn’t used when setting up direct deposit.

Incoming Wire Instructions:

Receiving Financial Institution:

Catalyst Corporate Federal Credit Union

6801 Parkwood Boulevard

Plano, TX 75024

ABA# 311990511

Further Credit to:

Peninsula Credit Union

ABA / Account# 325182344

Final Credit to:

Member’s name and account number at Peninsula Credit Union.

Outgoing Wires:

To initiate an outgoing wire request, please visit your local branch.

Processing Time:

Wires are transmitted Monday-Friday, with the exception of holidays. For a wire transfer to be processed the same business day, the wire must be received by the Credit Union before the following cut off times:

Domestic Wires – 1:00pm Pacific Time

International Wires – 11:30am Pacific Time

Wire requests received after these cut off times will be processed the next business day.

Fees apply to both incoming and outgoing wires, click here to see our current fee schedule.

Pay your Peninsula loan payments online with your debit card or checking account from any financial institution.

To begin:

- Click on the Pay Now button below to begin.

- Select “Express Payment” for one time use.

- Follow any helpful instructions displayed on the login page for entering your Peninsula Credit Union loan account number.

- Select your preferred payment method, and type your checking/savings account information.

- Enter the payment amount you wish to make (or the amount due as shown), and select the payment frequency.

- Review your loan payment request, and be sure to read the terms and conditions prior to submitting your payment.

- After submitting your payment, you will receive an immediate confirmation.

- If you chose to register, all registration and payment information is securely retained. It is not necessary to re-enter it upon future visits. Simply log in with your loan account number and password!

Mail Payment

Make check payable to Peninsula Credit Union

Write the loan number on the check and include a Loan Payment Coupon.

Mail payment to:

Peninsula Credit Union

PO Box 2150

Shelton, WA 98584

If you are paying your payment from another financial institution you can set up an automatic transfer, or what we call an ACH.

Fill out and sign the ACH authorization form and mail to:

Peninsula Credit Union

PO Box 2150

Shelton, WA 98584

WHAT IS THE SKIP-A-PAY PROGRAM?

Peninsula Credit Union’s Skip A Pay Program allows you to skip up to two monthly payments in a 12 month period on certain loans. Those payments are then added to the end of your loan term. Our skip a pay program does not impact your credit rating.

WHAT LOANS ARE ELIGIBLE FOR SKIPS?

The Skip A Pay Program applies to all Peninsula Credit Union loans except mortgages, home equity loans, VISA® accounts or new loans open for less than six months.

AM I ELIGIBLE TO SKIP MY PAYMENT(S)?

To be eligible, your loan must have been open for at least six months and be in good standing. You may not be eligible for other reasons, such as having an overdrawn Peninsula Credit Union checking account or any circumstance the credit union deems derogatory related to your account.

IS THERE A FEE?

There is a $30 fee per skip, per loan.

HOW DOES PARTICIPATING IN THE SKIP A PAY PROGRAM AFFECT MY LOAN?

The skipped months will be added to the end of your loan, extending the loan term. Interest will continue to accrue during skipped months.

WHAT IF I HAVE AUTOMATIC (ACH) PAYMENTS, CAN I PARTICIPATE IN THE SKIP-A-PAY PROGRAM?

If you have automatic payments from a Peninsula Credit Union account, or if we pull your payment automatically from another financial institution, we’ll arrange your skip for the month you selected. Please have your skip request to us at least seven (7) business days prior to your payment date. This gives us time to modify your ACH for the month you’ve requested your skip.

WHAT IF I PAY MY LOAN THROUGH ONLINE BILL PAY, CAN I PARTICIPATE IN THE SKIP-A-PAY PROGRAM? Bill Pay is different than automatic (ACH) payments. If you use Peninsula Credit Union’s Bill Pay or Bill Pay from any financial institution, you’ll need to log into Bill Pay to stop and restart the payment yourself. Don’t forget to turn it back on after your skip!

HOW OFTEN CAN I SKIP A PAYMENT?

As long as you continue to be eligible, you may skip any eligible loan up to two times in a 12 month period. Payments cannot be skipped in consecutive months.

CAN I SKIP A PAYMENT AT ANY TIME?

Yes, you can, but remember that you can only skip on the same loan a maximum of two times per calendar year, and you must wait at least sixty days between skips.